Instrument Business Outlook (IBO) has shared its annual forecast for the year ahead. The publication examines the current state of the scientific instrument market across sectors and instrumentation types and makes predictions for 2024.

Thank you to IBO for its insightful forecast, published on 17th January in Volume 32: Issue 19, and for allowing us to report on the findings. This blog will summarise the 2024 expectations with support from data provided by Strategic Directions International (SDi). IBO and SDi are part of Science and Medicine Group, a leading research and advisory firm serving the life science, analytical instrument, diagnostic, healthcare, radiology, and dental industries.

2023 in summary

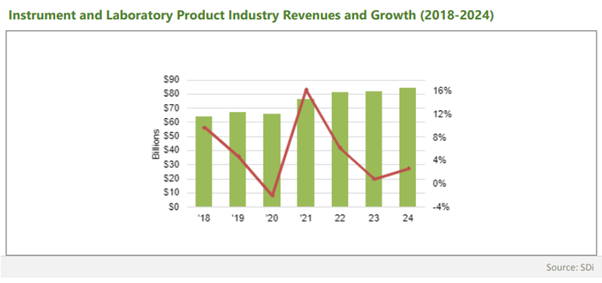

Overall, 2023 was a poor year across most segments of the analytical instrumentation industry due to a general global decline in investment. IBO reported growth of less than 1%, markedly worse than their previous forecast had predicted. The second half of the year saw a considerable downturn and the Chinese market in particular experienced a double-digit decline, the first decrease of that size in 20 years. In fact, Europe was the only region that performed better than expected. Total demand in 2023 has been measured at over $81 billion.

The outlook for 2024

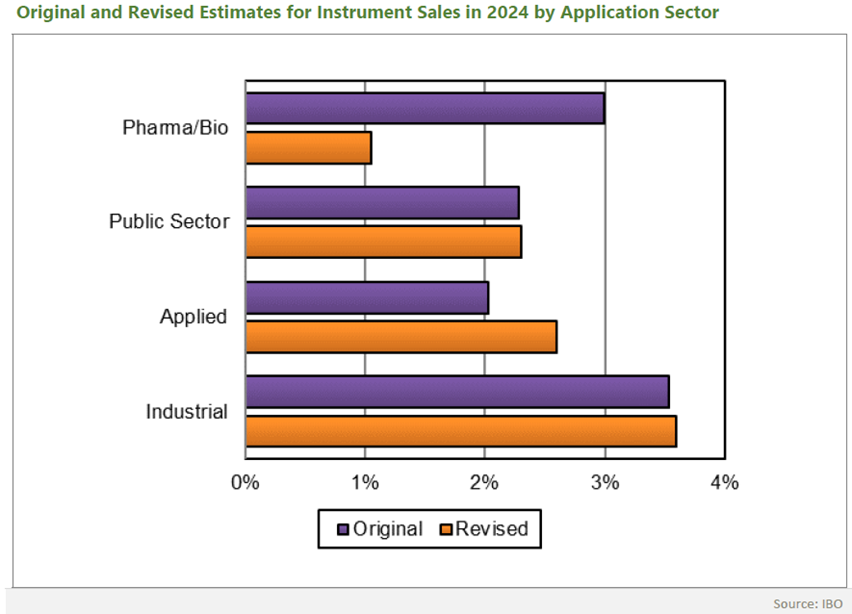

The bad news is that 2024 is expected to start in the same way that 2023 ended, but there is hope that market conditions will improve throughout the year. While 2024 will be a slow-growth year in comparison to long-term averages, it will be better than 2023, with market demand expected to grow in excess of 2%, resulting in total instrument industry revenues of $84 billion. IBO notes that, due to decreasing demand for COVID-19 testing, sample preparation in general will see a decline. However, all other technology segments are expected to experience low single digit growth, with molecular spectroscopy and life science instrumentation performing the best.

Life science instrumentation

- The difficult market conditions of 2023 are expected to continue meaning this segment will see only mid-single digit growth

- IBO suggests that the struggles faced by the pharma and biotech sector will persist but will eventually begin to stabilise

- A considerable growth in consumables is predicted.

Mass spectrometry

- IBO predicts slow growth across all mass spectrometry technology sectors due to various reasons including a reduction in academic expenditure and low demand in China

- In line with the overall forecast, the first half of the year for the mass spectrometry segment is expected to be the worst

- With stable suppliers making market entry difficult, Thermo Fisher Scientific will retain its place as market leader.

Chromatography

- The sales of all chromatography techniques are predicted to grow in low single digits

- Following a period of limited demand, IBO expects the consumables sector to rebound

- While instrument purchases will remain supressed in the first half of the year, a replacement cycle should drive sales in the second half.

Automation

- IBO predicts that the growth of the automation of routine lab processes will continue, albeit at a slower rate

- The market, however, will recede to more than $7 billion as a lack of funding has caused the pharma and biotech sector to stagnate

- Europe is expected to drive growth while the US lab automation market remains flat.

Surface science

- Most technologies will experience decreased growth

- Optical microscopes and scanning probe microscopy (SPM) in particular will stagnate due to macroeconomic problems in China

- Overall, IBO expects negative growth in demand in the early part of the year which will improve as the year progresses.

Molecular spectroscopy

- Demand in this segment should reach over $6 billion, illustrating a growth of more than 4%.

- IBO suggest that later in the year molecular spectroscopy should benefit from increased research and development (R&D) budgets and spending from the pharma and biotech sector

- The fasting growing technique of 2024 is expected to be Raman spectroscopy.

Atomic spectroscopy

- While IBO predicts that atomic spectroscopy will only grow in the low single digits, they expect greater growth in 2025

- Unlike other analytical instruments, atomic spectroscopy was not affected by the 2023 downturn in life science spending and so will not share in the end of year growth when spending in this sector is likely to increase

- Inductively coupled plasma mass spectrometry (ICP-MS) and optical emission spectroscopy (ICP-OES) are highlighted as the highest growing technologies.

Sample preparation

- Sample preparation is expected to continue to decline from its pre-pandemic peak as lab spending decreases, with speculated demand being $7 billion

- Inflationary pressures are predicted to remain an obstacle to lab activity

- Any growth will be driven by sonicators, extraction techniques and synthetic chemistry.

Materials characterisation

- The advanced material market should continue to drive growth as it did in 2023

- IBO reports that battery manufacturing is to play a key role in the materials characterisation market as the industry looks to improve battery technology

- The semiconductor market is set to rebound as a result of increased demand for particle characterisation technologies.

Laboratory equipment

- The laboratory equipment market is difficult to predict as it is not clear to what extent the pharma and biotech sector will recover

- However, IBO estimates a growth of more than 2%, reaching demand of over $6 billion

- Fastest growth should be seen in biological safety cabinets and gas generators.

IBO, an SDi publication, is a subscription-based newsletter issued twice a month that covers the latest developments in the life science and analytical instrument industry, and lab product markets. It is a must-read for anyone immersed in analytical instrumentation. Learn more about IBO here.

SDi provides vendors in the analytical instrument and life science tools industries with important market research, enabling them to make informed decisions. SDi’s 2024 Global Assessment Report will be available in April and will cover all the market segments mentioned in the blog in greater depth.

The Scott Partnership works with analytical instrumentation and life science businesses across the globe, supporting their entry into both local and international markets. Please get in touch to discuss your challenges and see how we can help support your business.

.jpg)