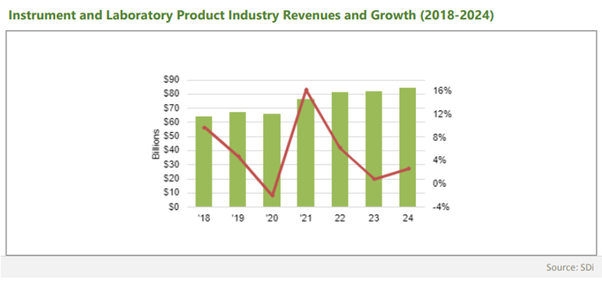

Instrument Business Outlook (IBO) has shared its mid-year forecast for the remainder of 2024. The publication revisits its forecasts for 2024, offering updates on the state of the scientific instrument market for the latter half of 2024.

This blog will summarise the 2024 expectations with support from data provided by Strategic Directions International (SDi). IBO and SDi are part of Science and Medicine Group, a leading research and advisory firm serving the life science, analytical instrument, diagnostic, healthcare, radiology, and dental industries.

Mid-year forecast in summary

Overall, IBO has revised its forecast for 2024 growth in the laboratory analytical and life science instrumentation industry downwards from 2.7% to 2.2%.

Key factors influencing the downward revision:

- Slow recovery in China: The Chinese economy has been slower to recover than expected, delaying the anticipated stimulus boost.

- Biopharma investment: Spending on laboratory instrumentation in the biopharma sector has been slower to increase than anticipated.

- Geopolitical events: While the overall geopolitical situation has not significantly deteriorated, there are concerns about potential conflicts in the Middle East and Latin America. Similarly, there has been political shifts seen throughout Europe.

Updated regional forecast

While the global growth forecast has been adjusted downwards, there are significant variations by region, with China experiencing a significant decline and Europe outperforming earlier forecasts.

Some major results affecting the regional forecast:

- China's economic downturn: The Chinese economy has experienced a significant downturn, leading to a decline in the instrument market for 2024.

- Europe's outperformance: Europe is expected to outperform the initial forecast, although growth remains historically low.

- Rest of world: All other regions have been adjusted downwards, but less than one percent in all cases.

- Global GDP growth: The IMF and OECD have increased their estimates for global GDP growth, but this has not significantly impacted the regional forecasts for the instrument industry.

Updated industry forecast

Although the applied markets are showing strength, the pharma/biotech segment continues to face challenges due to depressed capital expenditure and slower consumables spending.

Industry forecast highlights:

- Negative adjustment: The pharma/biotech segment received the largest negative adjustment in the mid-year forecast update, revised downward from 3.0% to 1.1%.

- Depressed capital expenditure: Many vendors are reporting reduced capital expenditures from the pharma industry, impacting new instrument placements.

- Pharma/biotech consumables spending: Some vendors are seeing declines in consumables spending, while others are reporting flat or positive growth.

- Strength in applied markets: Vendors have noted strength in the applied markets, leading to an upward revision of the forecast to 2.6% with growing environmental demand and stable hospital spending on research tools driving growth.

Thank you to IBO for its insightful forecast. IBO, an SDi publication, is a subscription-based newsletter issued twice a month that covers the latest developments in the life science and analytical instrument industry, and lab product markets. It is a must-read for anyone immersed in analytical instrumentation. Learn more about IBO here.

SDi provides vendors in the analytical instrument and life science tools industries with important market research, enabling them to make informed decisions.

The Scott Partnership works with analytical instrumentation and life science businesses across the globe, supporting their entry into both local and international markets. Please get in touch to discuss your challenges and see how we can help support your business in 2024 and beyond, or view a list of our services here.

.jpg)