Top-Down Analytics (TDA) has released its 2023 outlook for the analytical instruments industry, looking back over 2022 and providing forecasts and predictions for 2023.

2022 was, for many, the year of the new normal, with governments, industries, and individuals learning to navigate and manage the still persisting COVID-19. Overall, TDA notes uneven growth across all industry segments, following double-digit growth in all technology categories in 2021.

For 2023, global economic conditions should be considered, as well as the state of the industry in 2022. As a result, TDA predicts a positive outlook but slower, more varied gains across the market overall.

We are delighted to share information from the 2023 Instrument Industry Outlook Report published by TDA, which provides insights on the economic factors that are driving industry growth and impacting instrument sales.

2022 overview

In 2022, the overall lab industry, including PAI, grew 3.8% to $84.7 billion. TDA breaks down the market by technologies, end markets and geographies:

- Lab instruments and PAI each expanded by just over 3%

- Lab enclosures and furniture market experienced double-digit growth

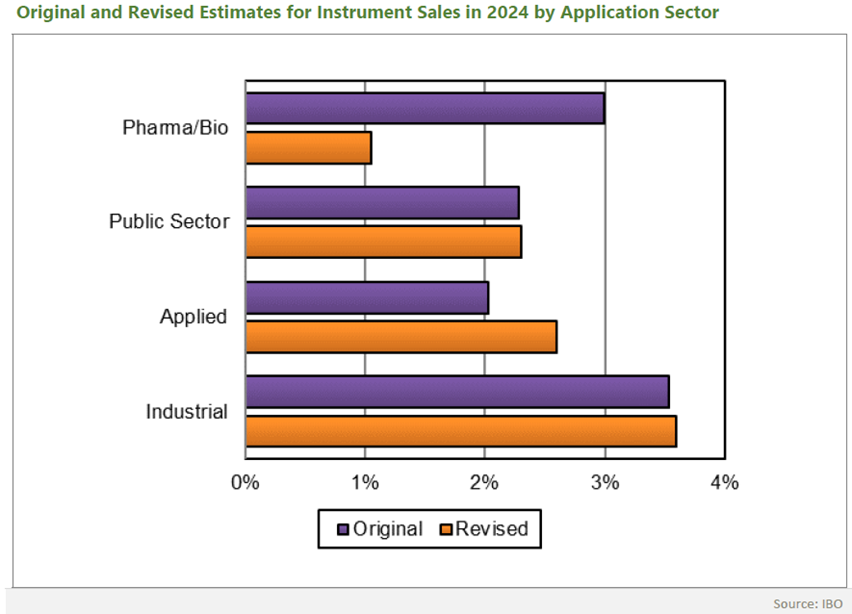

- Industrial and pharma/biopharma/contract research organisation (CRO) application sectors led end market growth

- Regional demand rose fastest in North America.

2023 outlook

Many macro-economic factors such as high inflation, tightening monetary policy, declining pandemic-related fiscal support, the war in Ukraine, and ongoing supply chain problems will have an impact on the instrumentation market in 2023. Nevertheless, several industrial forecasts show a positive outlook for the year, predicting steady growth. TDA calculates:

- Moderate overall growth of the lab and process analytical instruments (PAI) industry

- Demand for lab instruments, PAI and lab enclosures and furniture will each see single-digit growth

- Following exponential growth in 2022, many technology segments will decelerate in 2023 with smaller demand increases across the board

- North America will lead markets in terms of demand

- Pharma and biopharma will generate the most growth followed by the industrial end market.

Technology segments summary

As shown in Figure 2 below, TDA estimates that the mass spectrometry (MS) and equipment categories will lead industry growth, with demand for each rising by mid-single digits. Additionally, TDA predicts:

- Slower but continued positive growth of the chromatography segment

- The life science instruments segment will expand by low single-digits

- Single-digit growth is expected for the automation market

- Growth of the molecular spectroscopy segment will stay on track

- The atomic spectroscopy segment will increase by single digits

- Small gains are estimated for the materials analysis market

- Microscopy will rise modestly.

Market insights to guide planning and strategy

Informed decisions based on market insight can go a long way in ensuring your business growth and help you to focus on the best opportunities for analytical instrumentation in 2023.

Thanks to Glenn Cudiamat for allowing us access to the TDA report: 2023 Outlook Analytical Instruments Industry, which can be purchased here.

We work closely with clients in many of the segments in life sciences, technology and industrial, and help companies to communicate better with their complex audiences to raise awareness, change perceptions, generate demand and, ultimately, grow market share, in China, North America and Europe.

Contact us to find out more about communicating with global life sciences and laboratory markets.

About TDA: TDA is a leading provider of competitive intelligence (primary and secondary research) and benchmark data for scientific products, chemicals/reagents, consumables, automation and analytical instrumentation used in laboratory and process industries. TDA focuses on providing decision-making information to the leaders of scientific technology companies. Its dedication to the field allows it to offer clients a level of detail and insight that comes from constantly monitoring industry developments and from our ongoing market research projects and publishing activities.